How To Fill Out I9 Two Earners Multiple Jobs Worksheet

All employers must complete and retain Form I-9 Employment Eligibility Verification for every person they hire for employment after Nov. You can fill out the paper W4 to see if youre in the ballpark.

How To Fill Out Your W 4 Form To Keep More Of Your Paycheck 2019

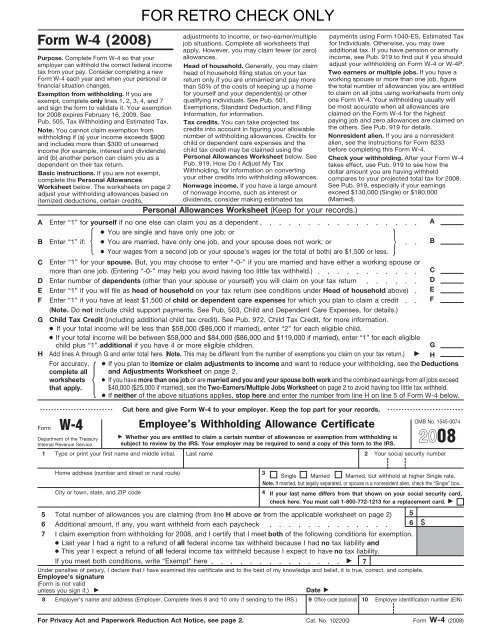

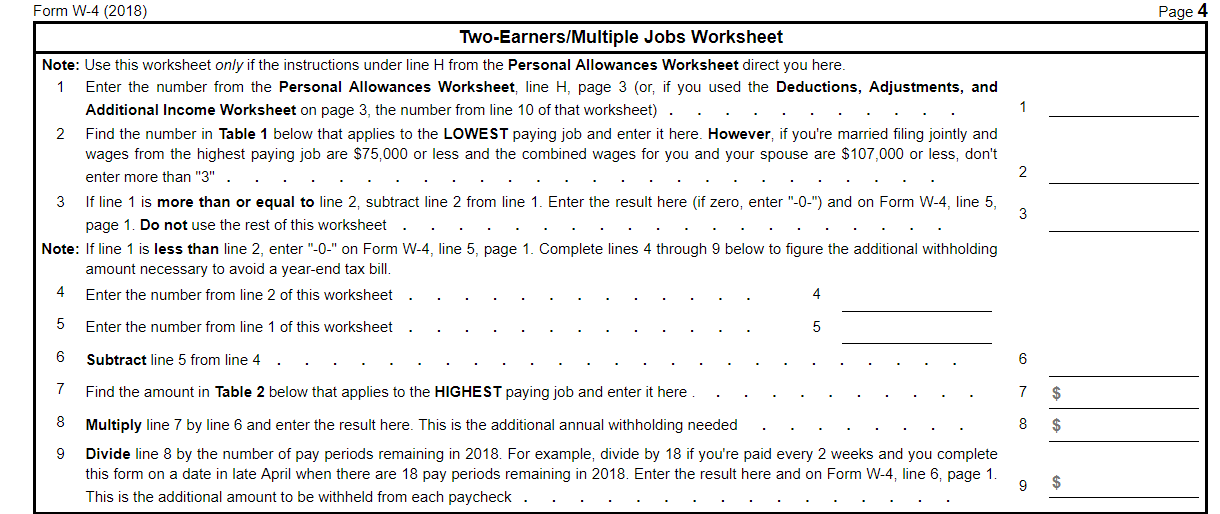

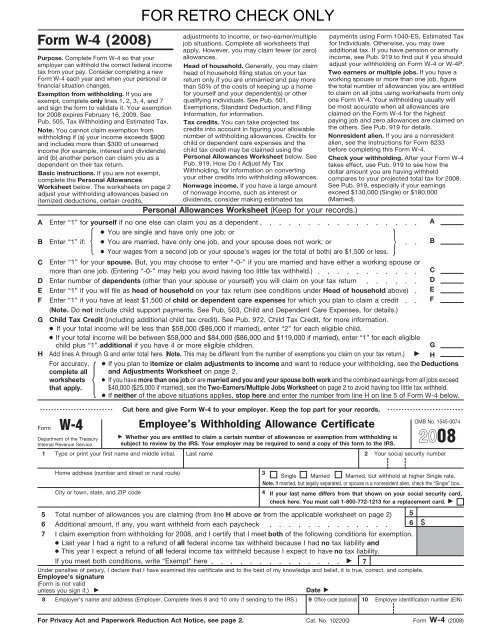

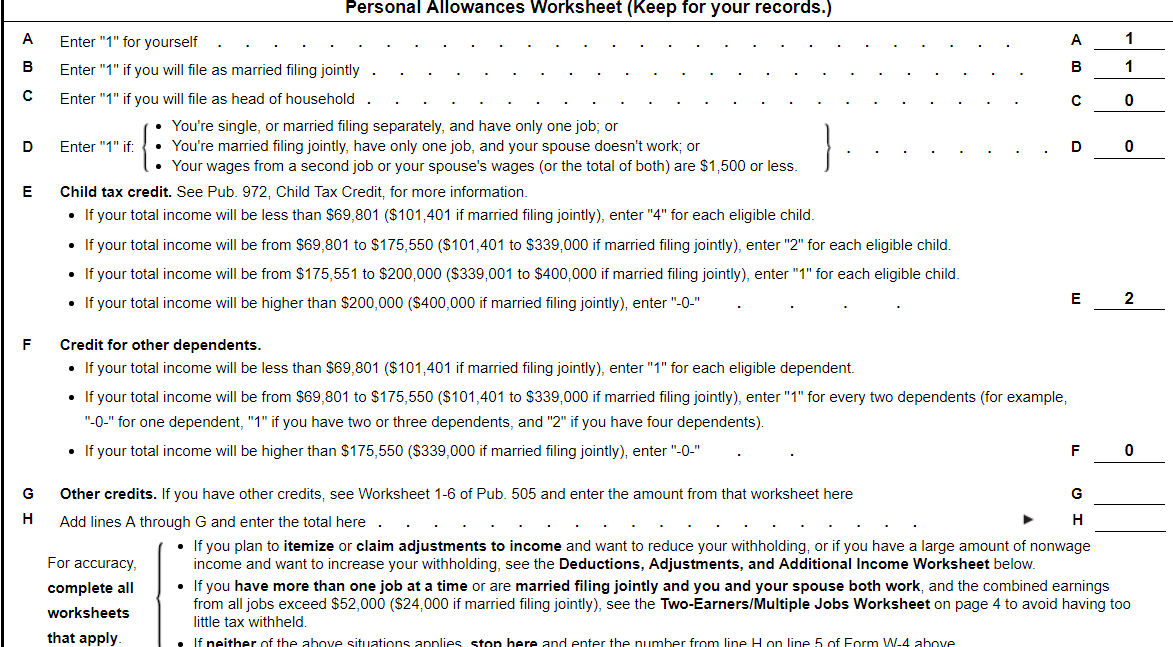

You can use the Two-EarnersMultiple Jobs Worksheet on the second page of the form to calculate your total number of allowances.

How to fill out i9 two earners multiple jobs worksheet. I filled out the W4 making some assumptions about you which would indicate that you need to file as Married 0 exemptions each and have 500 additional withheld throughout the year. To use the Two-EarnersMultiple Jobs Worksheet you must first fill out the Personal Allowances or Deductions Adjustments and Additional Income worksheets. W-4 Multiple Jobs Worksheet.

In this example if you are single and your highest-paying job pays 80000 multiply 1 by 930 to get 930. When filling out the Multiple Jobs Worksheet the first thing you will need to differentiate is whether you have two jobs including both you and your spouse or. Heres what the IRS has to say about it.

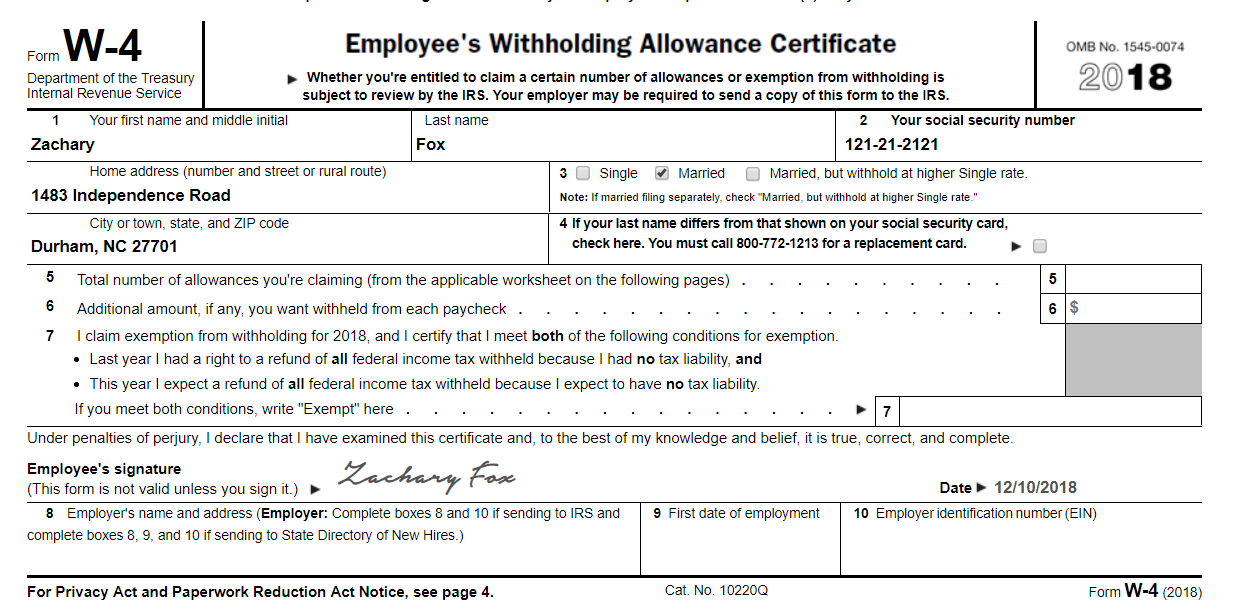

Multiple Jobs or Spouse Works. Depending on the number of jobs the employee andor spouse holds they can fill out the worksheet as follows. That will include your first name and middle initial last name Social Security number complete home address and your tax filing status.

IR-2018-124 May 24 2018. How to Fill Out Step 2. In the Commonwealth of the Northern Mariana Islands CNMI employers have had to complete Form I-9 CNMI for every employee hired for employment in the CNMI from Nov.

As long as the person works for pay or other type of payment. Couples should generally use the Two-EarnersMultiple Jobs Worksheet to calculate how many personal allowances to claim on the highest paying job and then claim zero allowances on all remaining jobs. Then depending on whether you are filing a joint return or using a different filing.

If your employee works other multiple jobs they would check the box next to section 2c and complete the Multiple Jobs Worksheet. Most commonly this step is for anyone who has more than one job or is married filing jointly and whose spouse works. Part of the W-4 Form is the Two-EarnersMultiple Jobs Worksheet.

Enter the total from line 9 of the Two-EarnerMultiple Jobs Worksheet into line 6 of the Employees Withholding Allowance Certificate Step 4 Enter exempt on line 7 if you qualify for tax exemption because you had no tax liability last year and expect no tax liability this year. Make sure to complete the two earners worksheet. WASHINGTON The Internal Revenue Service urges two-income families and those who work multiple jobs to complete a paycheck checkup to verify they are having the right amount of tax withheld from their paychecks.

You can begin by completing the general information requested in Step 1 Lines a through c. If you dont want to disclose that fact dont check the box. If an employee has more than one job or theyre married filing jointly and have a working spouse theyll need to fill out step 2.

Line 1 and line 5 should be 2. If your spouse works and you file jointly or if you have a second or third job you can use either the IRS app or the two-earnersmultiple jobs worksheet page three of the W-4 instructions to calculate how much extra should be withheld you put this amount in Step 4. That makes 8 3050 and that makes 9 11731.

Multiple Jobs or Spouse Works. If both go married0 and the husband it could be either really includes an additional 14070 the refund will be about 303. Multiple Jobs or Spouse Works asks you to Complete this step if you 1 hold more than one job at a time or 2 are married filing jointly and your spouse also works.

After filling out the worksheet. If you want to download the image of Personal Allowances Worksheet Help with Two Earners Multiple Jobs Worksheet How to Fill Out A W4 with simply right click the image and choose Save As. This helps to make sure that enough taxes are withheld from your.

The IRS Withholding Calculator can help them navigate the complexities of multiple employer tax situations. To figure out how many allowances to claim use the two-earnersmultiple jobs worksheet. Use the IRSs Multiple Jobs Worksheet located on page 3 of the W-4 if you andor your spouse work either two or three jobs at the same time.

The worksheet starts with the number of allowances you would be able to claim based on either the personal allowances worksheet or the deductions and adjustments worksheet. 6 1986 in the US. Both should file married 0 and the husband should include the extra 11731.

Handphone Tablet Desktop Original Size. Multiple Jobs or Spouse Works. This sheet is typically filled out if you have multiple jobs or if you are married and both you and your spouse work.

Step 2 is where things start to get a bit complicated. Checking box 2c tells your employer that you have multiple jobs. These worksheets account for your.

If both you and your spouse are employed and expect to file a joint return figure your withholding allowances using your combined income adjustments deductions exemptions and credits. Multiply the absolute value of the negative number from Step 3 by the appropriate number from Table 2 at the bottom of the Two-EarnersMultiple Jobs Worksheet.

W 4 Form Complete The W 4 Form For Zachary Fox A New Chegg Com

W 4 Form Complete The W 4 Form For Zachary Fox A New Chegg Com

Http Www Bcc Cuny Edu Wp Content Uploads 2018 10 Employment Record Payroll Forms Pdf

How To Fill Out Your W 4 Form To Keep More Of Your Paycheck 2019

Pin By Sheriff Engineering Solutions On Quick Saves In 2021 Employee Tax Forms Shocking Facts Tax Forms

Form I 7 Section 7 Examples Ten Top Risks Of Attending Form I 7 Section 7 Examples I 9 Letter Of Recommendation Passport Application Form

Form W 4 2012 Tax Forms How To Get Money Need To Know

W 4 Federal Tax Withholding Allowance Certificate

Https Leg Mt Gov Content Districting 2020 Meetings May 203 202019 Dac May3 2019 Ex1 Pdf

W 4 Form Complete The W 4 Form For Zachary Fox A New Chegg Com

2018 Tax Forms W4 Elegant Two Earners Multiple Jobs Worksheet Best Basic Explanation W 4 Models Form Ideas

Pin By Bianca Kim On W 4 Form Tax Forms Form W4 Tax Form

Starting A New Job Be Prepared To Fill Out These 5 Forms Financial Avenue